Consensus 2025

Consensus took place between 17 March - 9 May 2025, with the Levy Proposals supported by 67.2% of employers who are likely to pay.

These results have been collected from 14 Prescribed Organisations (POs) that speak on behalf of their Levy paying members and, secondly, a representative independent survey of 4000 employers that are not members of a PO. Results from the POs and the survey are weighted to ensure all employers are represented equally. To find out more on the Consensus process read our Consensus FAQs (PDF, 1.2MB).

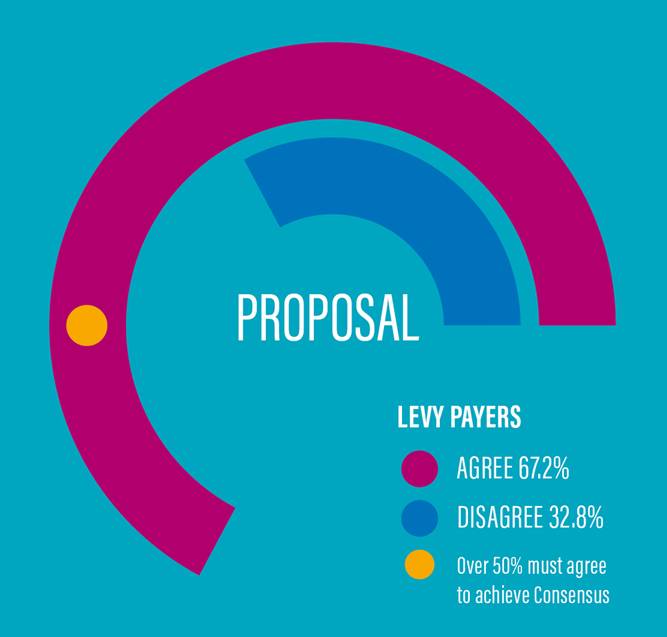

Overall result

67.2% of likely Levy payers agreed with the Proposal while 32.8% disagreed.

Results also must be measured in terms of how much Levy payable is paid by supportive employers and this was 72.0% in favour. Both measures must be higher than 50% for Consensus to be achieved.

Results breakdown

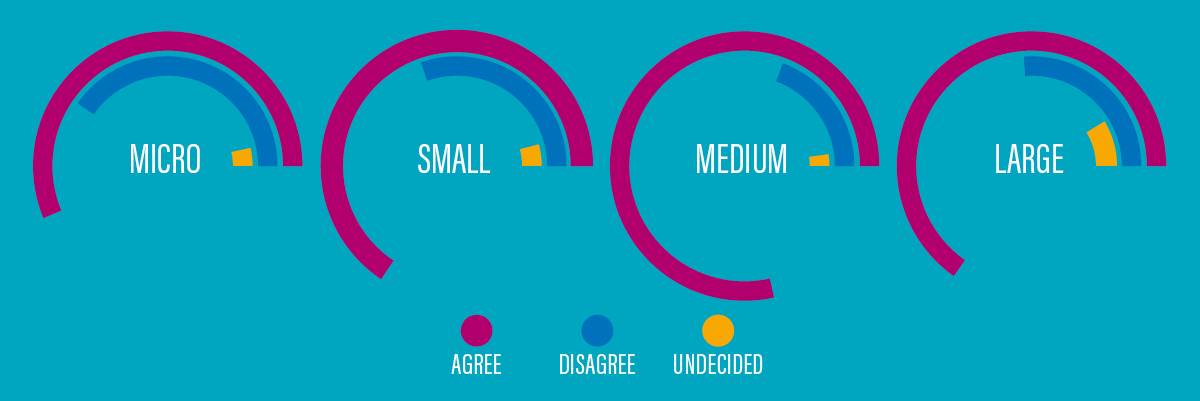

Independent survey of employers not members of a Prescribed Organisation

Micro

- 56.3% agree

- 40.3% disagree

- 3.4% undecided

Small

- 65.6% agree

- 30.3% disagree

- 4.1% undecided

Medium

- 78.5% agree

- 19.3% disagree

- 2.2% undecided

Large

- 65.2% agree

- 26.1% disagree

- 8.7% undecided

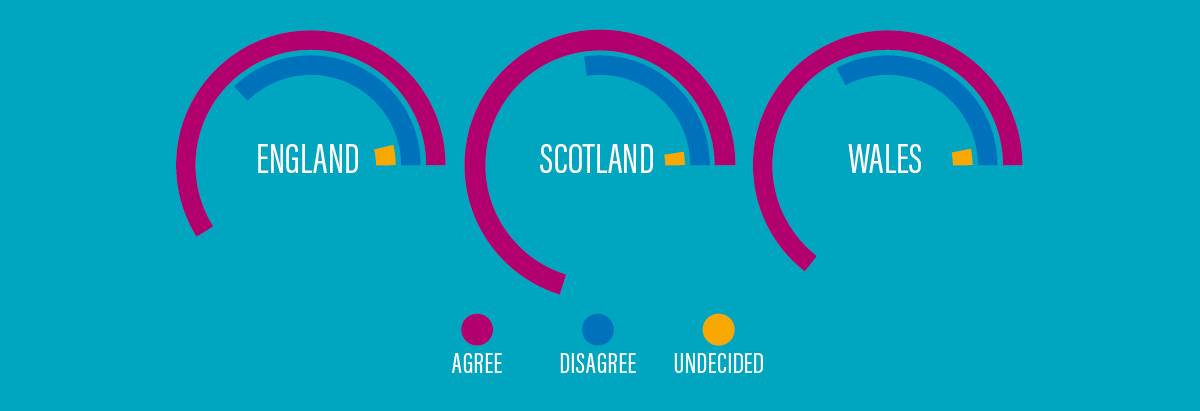

By nation

England

- 58.9% agree

- 37.3% disagree

- 3.8% undecided

Scotland

- 70.2% agree

- 27.3% disagree

- 2.5% undecided

Wales

- 64.4% agree

- 32.7% disagree

- 2.9% undecided

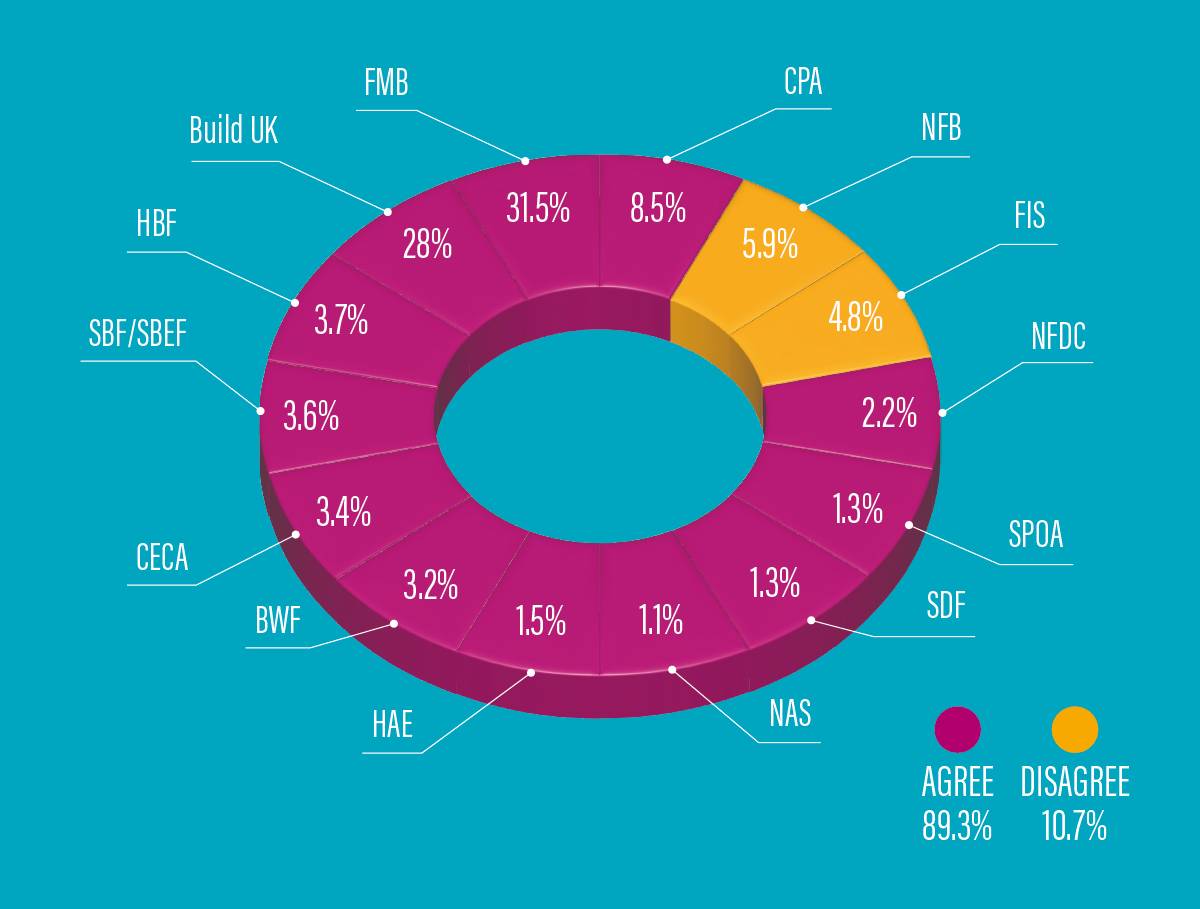

Prescribed Organisations

12 POs agreed (89%) with the Proposals and 2 disagreed (11%). This chart shows the Employer representivity of each PO.

12 Prescribed Organisations agreed

- Build UK

- British Woodworking Federation (BWF)

- Civil Engineering Contractors Association (CECA)

- Construction Plant-hire Association (CPA)

- Federation of Master Builders (FMB)

- Hire Association Europe (HAE)

- Home Builders Federation (HBF)

- National Association of Shopfitters (NAS)

- National Federation of Demolition Contractors (NFDC)

- Scottish Building Federation (SBF)

- Scottish Decorators Federation (SDF)

- Scottish Plant Owners Association (SPOA).

2 Prescribed Organisations disagreed

- Finishes and Interiors Sector (FIS)

- National Federation of Builders (NFB).

Consultation Report

In preparation for the Consensus, an industry-wide consultation on the draft Levy Proposals 2026-29 was completed. The Consultation Report (PDF, 574KB) shares the findings.

The Levy Proposals 2026 - 2029

To retain Levy rates at:

- PAYE: 0.35%

- Net paid (Taxable) CIS Sub-contractors: 1.25%.

- We are proposing to increase the Levy Exemption and Reduction Thresholds to £150,000 and £500,000.

Meaning if your employee payroll and Net paid (taxable) CIS subcontractors combined is less than £150,000 you will not pay a Levy. If you are between £150,000 and £499,999 you will receive an automatic reduction of 50%. This approach was supported by a majority of employers at a recent consultation and means we will continue to support our smallest employers, so the Levy delivers for all.